TRX Price Prediction: Technical Positioning and Market Factors

#TRX

- TRX trades slightly above its 20-day moving average, suggesting near-term stability

- MACD indicators show bearish momentum but potential convergence

- Broader market sentiment remains cautious despite positive blockchain development news

TRX Price Prediction

TRX Technical Analysis

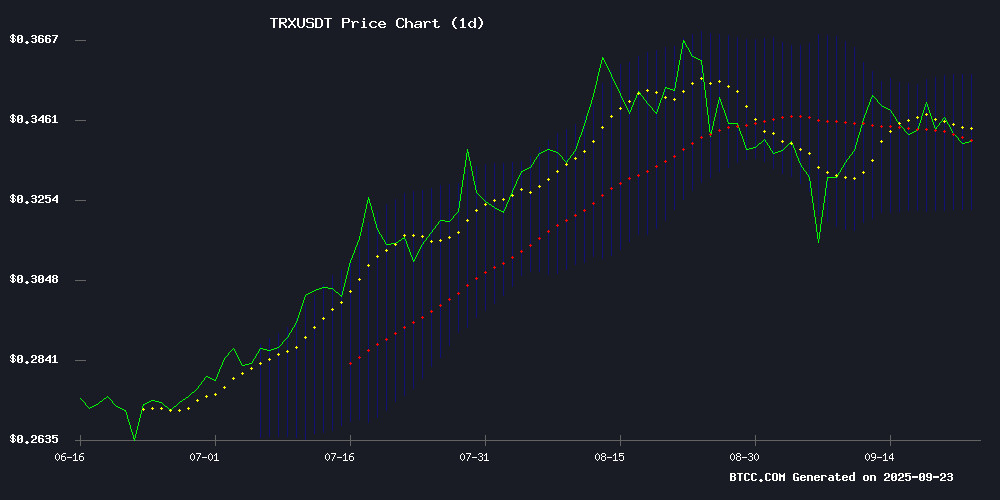

TRX is currently trading at 0.34060000 USDT, slightly above its 20-day moving average of 0.340385, indicating potential short-term stability. The MACD reading of -0.007360 suggests bearish momentum, though the histogram shows some convergence. Bollinger Bands position the price NEAR the middle band, with resistance at 0.357761 and support at 0.323009.

According to BTCC financial analyst Mia, "TRX shows mixed signals technically. While trading above the 20-day MA is positive, the MACD remains in negative territory. A break above the upper Bollinger Band could signal upward momentum, but current levels suggest consolidation."

Market Sentiment Analysis

The cryptocurrency market faces headwinds as major tokens decline, though blockchain development continues with Keeta's mainnet launch and India's growing Web3 hub status. These developments could provide long-term support for established projects like TRON.

BTCC financial analyst Mia notes, "While broader market sentiment is cautious due to the current slide, fundamental blockchain infrastructure development remains strong. TRX could benefit from increased adoption as newer platforms like Keeta enter the space, potentially driving interoperability demand."

Factors Influencing TRX's Price

Keeta Launches Mainnet to Rival Solana and Ethereum Blockchain

Keeta, a new layer-1 blockchain backed by former Google CEO Eric Schmidt, has officially launched its mainnet, claiming transaction speeds surpassing Solana, Ethereum, and Tron. During testing, the network processed 28.7 million transactions and produced 42.6 million blocks. A June stress test demonstrated 11.2 million transactions per second—2,500x faster than Solana and exceeding the combined capacity of Visa, SWIFT, and FedNow.

The launch saw 235 million funded wallets, with 42 million already executing transactions. Over 13 exchanges listed Keeta's token, which surged 190% from its yearly low, propelling its market cap to $457 million and a fully diluted valuation of $1.08 billion. Founder Ty Schenk called it "the most advanced, scalable L1 in the world."

India Blockchain Month 2025 Set to Elevate New Delhi as a Global Web3 Hub

New Delhi will host India Blockchain Month 2025 in September, marking the festival's second and largest iteration. The event aims to position the city as a focal point for Web3, AI, and real-world asset tokenization innovation. Eight key events are planned, including the Web3preneur Summit and ETHGlobal Delhi Week, featuring over 15 speakers from prominent entities like Arbitrum, Ava Labs, and Bharat Web3 Association.

The festival will unfold across two venues—JW Marriott Aerocity and Welcomhotel by ITC Hotels—with a lineup covering tokenization opportunities, AI-Web3 convergence, and women's advancement in crypto. ETHGlobal Delhi Week, running concurrently from September 22-28, will draw developers, investors, and regulators globally.

Cryptocurrency Market Slides as Major Tokens and Altcoins Tumble

The cryptocurrency market opened the week with significant losses, as bitcoin (BTC) and ether (ETH) led a broad decline that wiped out $1.5 billion in leveraged positions. The downturn followed a Federal Reserve interest-rate cut that failed to buoy risk assets as anticipated.

Alex Kuptsikevich, FxPro's chief market analyst, noted technical breakdowns in BTC's price action. "BTCUSD exited its September uptrend channel, breached key support levels, and plunged below the 50-day moving average," he said. "This confluence of bearish signals points to further downside unless macroeconomic sentiment shifts."

Futures markets reflected the pessimism. Open interest for top-20 tokens excluding BTC and HYPE collapsed by double digits, while Binance's USDT-margined BTC futures saw short positions climb to 276,000 BTC. Negative funding rates in TRX, ADA, LINK and SHIB perpetual contracts revealed overwhelming bearish bias across altcoins.

Is TRX a good investment?

Based on current technical and fundamental analysis, TRX presents a mixed investment case. The token trades near key technical levels with some bullish indicators but faces broader market headwinds.

| Metric | Current Value | Interpretation |

|---|---|---|

| Price vs 20-day MA | 0.34060000 (above MA) | Slightly bullish |

| MACD | -0.007360 | Bearish momentum |

| Bollinger Position | Near middle band | Neutral consolidation |

| Market Sentiment | Cautious | Short-term pressure |

As BTCC analyst Mia suggests, "TRX's investment appeal depends on time horizon. Short-term traders should watch for a break above $0.357 resistance, while long-term investors may find value in TRON's established ecosystem amid ongoing blockchain development."